child tax credit 2022 calculator

Ad Download or Email IRS Publication 972 More Fillable Forms Register and Subscribe Now. For 2018 - 2021 Returns the ACTC is worth up to 1400.

Final Estimated Tax Payment For 2021 Is Due This Week Kiplinger In 2022 Tax Payment Estimated Tax Payments Tax Deadline

Making a new claim for Child Tax Credit.

. Tax credits and benefits for individuals. You can claim the Child Tax Credit for each qualifying child who has a Social Security number that is valid for employment in the United States. Choose the number of qualifying children you have.

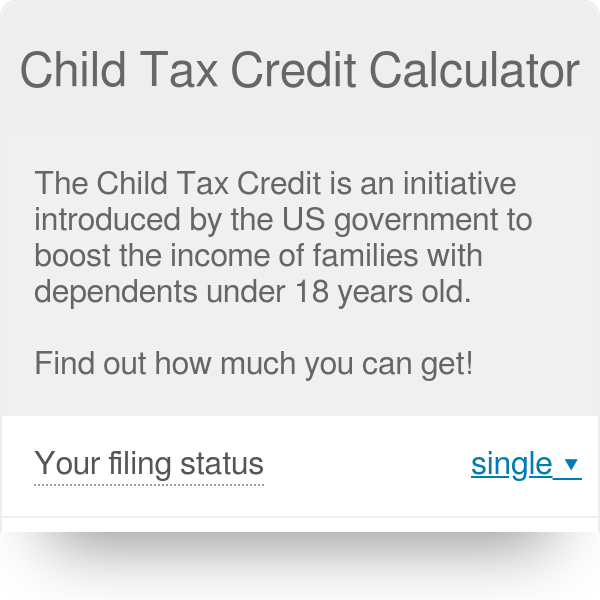

Select your filing status from the drop-down list. Enter the number of qualifying dependents aged 5 or younger age as of December 31 2021 for Tax Year 2021 including dependents or children born during 2021. For 2022 that amount reverted to 2000 per child dependent 16 and younger.

On Thursday July 28 2022 DRS will be participating in a community event to raise awareness about the 2022 child tax rebate. They would receive another 3600 after filing their tax return by April 2022. The IRS will be distributing the final sixth round payment from the Child Tax Credit.

This calculator is for 2022 Tax Returns due in 2023. You can use this calculator to see what child and family benefits you may be able to get and how much your payments may be. In order to get this payment parents must make less than 125000 and must have at least two children under the age of 13.

The first one applies to the extra credit amount added to. You can calculate your credit here. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes.

This calculator is available for your convenience. Max refund is guaranteed and 100 accurate. You can use this EIC Calculator to calculate your Earned Income Credit based on the number of qualifying children total earned income and filing status.

The amount is increased for children under the age of 6 to 3600 while remaining fully refundable. Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. One of which has to do with the Child Tax Credit.

They would be eligible to receive 3600 in six monthly installments of 600 between July and December 2021. Use the child and family benefits calculator to help plan your budget. Our child tax credit calculator will help you estimate your refundable child tax credit.

The latest round of federal stimulus was worth up to 1400 while the child tax credit increased to a maximum of 3600. And luckily there are multiple tax refund calculators online. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

The credit will be fully refundable. But keep in mind you might want to have yourW-2 formin front of you because this will show important. For children under 6 the amount jumped to 3600.

Wednesday April 6 2022. Find more information on 2022 Refundable Child Tax Credits. If your MAGI is over 75000 the credit is phased.

Partial Expanded Child Tax Credit. Overview of child and family benefits. The credit is now available for children aged 18.

The Child and Dependent Care Tax Credit is worth anywhere from 20 to 35 of qualifying care expenses. Provide the following information and then click Calculate My EIC to retrieve results. A couple that makes about 100000 with two qualifying children under the age of six can expect to receive 7200 under the new plan.

The amount you can get depends on how many children youve got and whether youre. The following amounts are for the payment period from July 2022 to June 2023 and are based on your AFNI from 2021. It could give some families up to 8000 heading into 2022.

PdfFiller allows users to edit sign fill and share all type of documents online. If your child is eligible for the disability tax credit you may also be eligible for the child disability benefit. In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a credit of up to 3000.

Your Adjusted Gross Income AGI determines how much you can claim back. Last year American families were thrown a lifeline in the form of the boosted Child Tax CreditIn 2021 the credit was worth up to 3600 for children under the age of. Be under age 18 at the end of the year.

Tax Changes and Key Amounts for the 2022 Tax Year. Any excess advance child tax credit payments do need to be paid back IRS. Start with a free eFile account and file federal and state taxes online by April 18 2022.

The maximum is 3000 for a single qualifying person or 6000 for two or more. If your MAGI is 150000 or under you will receive 3600 per child under 6 and 3000 per child age 6-17. DRS is partnering with the United Way and the Early Care and Education Center in Waterbury to participate in the BTs Sparkler Summer Series.

The IRSstarted accepting tax returns on January 24. The child tax credit is now 3000 for children between the ages of 6 and 18. Simple or complex always free.

Ad Free means free and IRS e-file is included. Estimate how much tax credit including Working Tax Credit and Child Tax Credit you could get every 4 weeks during this tax year 6 April 2021 to 5 April 2022. Already claiming Child Tax Credit.

Parents with higher incomes also have two phase-out schemes to worry about for 2021. For purposes of the Child Tax Credit and advance Child Tax Credit payments your modified AGI is your adjusted gross income from the 2020 IRS Form 1040 line 11 or if you havent filed a 2020 return the 2019 IRS Form 1040 line. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Thursday July 28 2022 600 pm. Enter the number of qualifying dependents between the ages 6 and 17 age as of Dec. To be a qualifying child for the 2021 tax year your dependent generally must.

Under the new provisions families are set to receive a 3000 annual benefit per child ages 6 to 17 and 3600 per child under 6 in the tax year 2021. Be your son daughter stepchild eligible foster child brother sister. File a federal return to claim your child tax credit.

Distributing families eligible credit through monthly checks for. 31 2021 for Tax Year 2021. The maximum child tax credit amount will decrease in 2022.

Calculate how much you can get. The reliability of the results depends on the accuracy of the information. There are also maximum amounts you must consider.

Estimate your 2021 Child Tax Credit Monthly Payment. In 2022 US expats are eligible to receive between 1400 up to 3600 per qualifying child on their 2021 US Tax Return. Ages five and younger is up to 3600 in total up to 300 in advance monthly Ages six to 17 is up to 3000 in total up to 250 in advance monthly Additionally a portion of your amount is reduced by 50 for every 1000 over certain.

Child tax credit 2022 calculator.

The Monthly Child Tax Credit Calculator See How Much You May Qualify For Forbes Advisor

Tax Credit Definition How To Claim It

2022 Tax Return How To Factor In Your Child Tax Credit And Covid Costs Npr

Free Incridible Tools Percentage Calculator In 2022 Free Tools Free Online Tools Financial Management

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

Who S Eligible For The Child Tax Credit And What It Means This Tax Season Cnet

2021 Child Tax Credit Calculator How Much Could You Receive Abc News

What Is A Tax Credit Vs Tax Deduction Do You Know The Difference Tax Deductions Tax Credits Money Apps

Fy 2021 22 Or Ay 2022 23 New Income Tax Return E Filing Exemptions Deductions E Payment Refund Only 30 Second

Taxcaster Free Tax Calculator Estimate Your Tax Refund Turbotax Tax Refund Turbotax Tax

Individual Tax Prep And E File At Taxleaf 55 Off In 2022 Income Tax Notary Small Business Tax

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Businessman Hand Working With Finances About Cost And Calculator And Latop With Mobile Phone On Withe Desk In In 2022 Investment Banking Businessman Hand Business Man

Casio Scientific Calculator With Natural Textbook Display Casio Scientific Calculator With Natural Textbook Display

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Federal Income Tax Calculator Find Your Irs Refund Payment For Your Return

Tax Credit Calculator Sunnybrook Foundation

Child Tax Credit 2022 Could You Get 750 From Your State Cnet